New legislation signed by Governor Glenn Youngkin will widen the current pathways to CPA licensure effective Jan. 1, 2026.

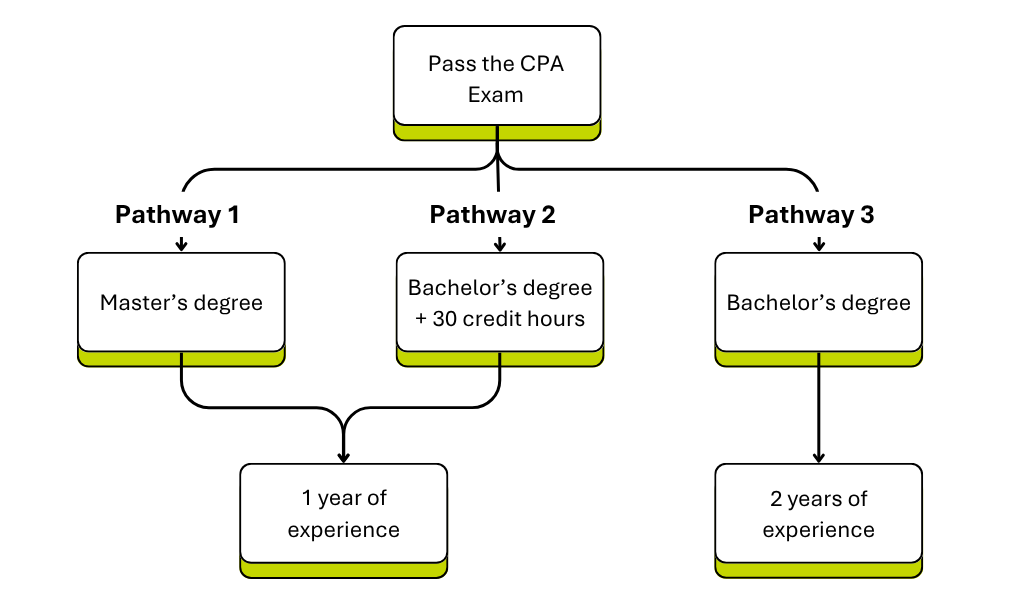

In general, to become a licensed CPA in Virginia, you will still need to meet the 3 E’s: education, exam and experience. However, beginning in 2026, CPA candidates can choose one of three pathways to licensure in Virginia, each combining education and experience differently.

All applicants must still pass the CPA Exam, receive a bachelor’s or higher degree and complete an accounting concentration or equivalent as defined by the board. The new legislation has removed the total semester credit hour requirements historically associated with earning a Bachelor’s degree (120 hours) or a Master’s degree (30 hours).

Virginia’s Pathways to CPA Licensure (effective Jan. 1, 2026)

You can find the documentation needed to apply on the Licensure Requirements page.