Virginia-specific CPA Evolution information

Recently the Uniform CPA Exam went through an overhaul known as CPA Evolution, and a new exam launched Jan. 10, 2024. Below you can find a list of changes the VBOA made ahead of CPA Evolution to ease the transition.

Credit relief initiative

The VBOA approved credit relief for those who had a credit that expired between January of 2020 and Nov. 30, 2023, and was not replaced with a new passing score. This was an expanded version of NASBA’s Credit Relief Initiative, a response to disruptions exam candidates faced during the COVID-19 pandemic.

30-month credit approval

The board approved a motion permanently changing the credit earning window from 18 to 30 months for all credits earned after Jan. 9, 2024. Any credits that were still active on Dec. 15 were also extended to have a lifespan of at least 30 months.

Re-exam fee suspension

The board temporarily suspended the $20 fee associated with re-exam requests until at least Jan. 1, 2025. Please note: Changes affecting credit expiration dates have already been made and are reflected in NASBA’s CPA portal, CPA Central.

CPA Evolution presentation

Board Vice Chair Nadia Rogers gives a presentation on CPA Evolution for VBOA meetings on college campuses. You can find her slides here.

General CPA Evolution information

Exam transition

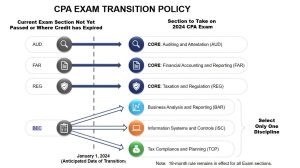

If some, but not all sections of the old exam were passed, exam candidates will need to follow NASBA’s approved transition policy (see image). For other questions, check out NASBA’s CPA Evolution Transition FAQs.

Testing and score schedule

You can find the tentative 2024 testing and score release schedule here.

Exam blueprints

Want to know what’s covered in the exam? Download the CPA exam blueprints here from AICPA.